Income Minimum To File Taxes 2025. For heads of household, it’s $20,775. The income thresholds for 2025 (for 2025 tax year filing), are detailed in the irs’s 1040 instructions, and are as follows:

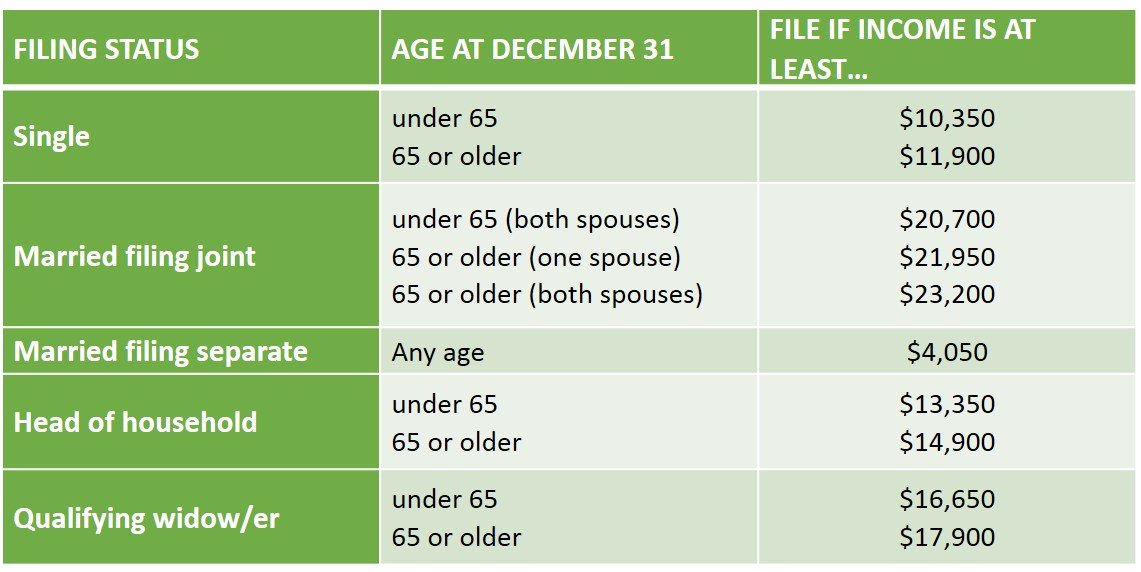

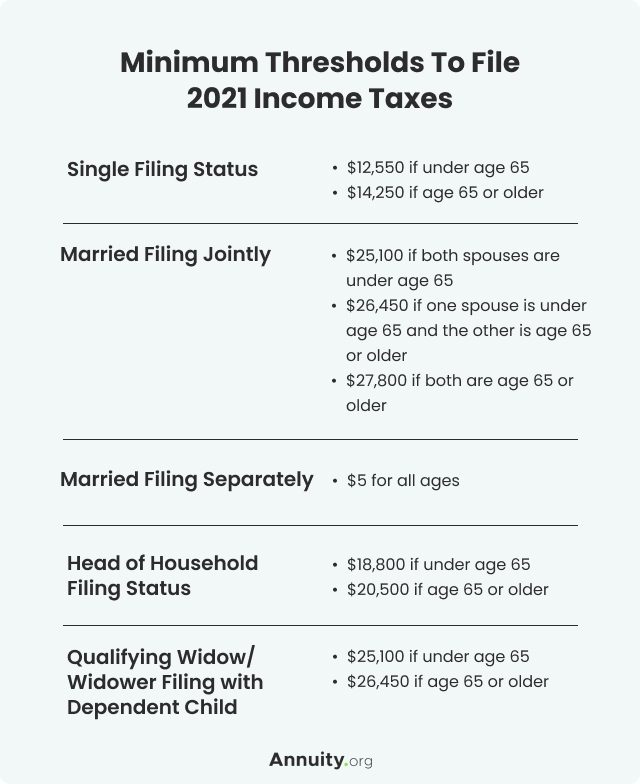

When it comes to filing, the following taxable income thresholds determine whether you should file a tax return:

Mastering Your Taxes 2025 W4 Form Explained 2025 AtOnce, Have to file a tax return. Your gross income is over the filing requirement.

When Should You File A U.S. Federal Tax Return Aylett Grant, Income tax rates and thresholds (annual) tax rate taxable income threshold; Requesting a tax extension is an easy process, and it is granted automatically after you.

2025 Filing Taxes Guide Everything You Need To Know, For the 2025 tax year, the minimum income required to file taxes is $13,850 for single filers and $27,700 for married couples filing jointly, according to the irs. Germany residents income tax tables in 2025:

Minimum to File Taxes 2025 2025, 2025 federal income tax brackets and rates in 2025, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (table 1). According to the kentucky dor, if you get a federal extension, you automatically have an extension to file with kentucky.

Minimum to File Taxes 2025 2025, In 2025, the top tax rate (spitzensteuersatz) will therefore apply to an annual income of 66,761 euros (2025: Interest income) over $1,100, or earned income (i.e.

Tax Checklist What Your Accountant Needs to File Your, You probably have to file a tax return in 2025 if you're under 65 and your 2025 gross income was at least $13,850 as a single filer, $20,800 if head of household or $27,700 if. $3,100 or your earned income (up to.

Maximize Your Paycheck Understanding FICA Tax in 2025, For single filers and married individuals filing separately, it’s $13,850. To determine if you’re one of the millions who have to file a return, start with three things:

Tax rates for the 2025 year of assessment Just One Lap, Citizens and permanent residents who work in the united states need to file a tax return if they make more than a certain amount for the year. The tax year 2025 maximum earned income tax credit amount is $7,830 for qualifying taxpayers who have three or more qualifying children, an increase of from $7,430 for.

Minimum Requirements How Much Money Do I Have to Make to File, You probably have to file a tax return in 2025 if you're under 65 and your 2025 gross income was at least $13,850 as a single filer, $20,800 if head of household or $27,700 if. A tax extension can give you six more months to file your 2025 tax return.

How to Know the Minimum Amount to File Taxes, Just be sure to attach the federal form (form 4868). Carry out a roth conversion.

The irs is currently planning for a threshold of $5,000 for tax year 2025 (the taxes you file in 2025) as part of the phase in to implement the lower over $600 threshold enacted.